Another Governance Fiasco with Builder.ai | Plus: Empire Building in the Age of AI

Boardroom Governance Newsletter #65 | June 12, 2025

Builder.ai’s Collapse & Governance Failures

In June of 2025, Builder.ai, a London-based AI software startup previously valued at $1.5 billion and backed by prominent investors including Microsoft, Softbank, Qatar Investment Authority (QIA), Insight Partners, IFC, and Iconiq Capital, filed for Chapter 7 bankruptcy protection in the U.S. Bankruptcy Court for the District of Delaware, marking yet another startling governance scandal in the tech sector. With over $500 million raised from a roster of prominent investors, Builder.ai’s ambitions seemed limitless. Founder Sachin Dev Duggal had marketed Builder.ai as a revolutionary AI-driven platform enabling non-coders to easily build custom apps. However, beneath its soaring valuation and high-profile partnerships, including with AWS and Microsoft, a web of accounting irregularities and dubious practices quickly unraveled.

Internal investigations revealed that Builder.ai had significantly overstated its financial performance. While the company had publicly projected revenues of approximately $220 million for 2024 and had reported $180 million for 2023, the actual figures were closer to $55 million and $45 million respectively. The startling discrepancies stemmed from questionable accounting practices, including booking heavily discounted contracts at full price, treating unpaid trade-fair deposits as revenue, and alleged “round-tripping” transactions involving Indian tech firm VerSe Innovation.

Further exacerbating the scandal, an alleged $120 million of Builder.ai’s reported revenue was discovered to be either inflated or potentially fabricated through third-party resellers, especially concentrated in the Middle East. The credibility of the audits also came under intense scrutiny, as previous auditing had been conducted by smaller firms closely linked to founder Duggal, raising significant conflicts of interest concerns.

The governance crisis deepened after Duggal resigned as CEO in February but retained his board seat and the unusual title of “chief wizard.” The board, which included investor representatives1, came under criticism for apparently failing to implement effective oversight and allowing conflicts of interest to persist unchecked. New CEO Manpreet Ratia immediately initiated a comprehensive audit and internal investigation, which rapidly exposed the extent of the financial misrepresentations. Duggal, who relocated to the UAE amidst the turmoil, has vigorously denied any wrongdoing, instead suggesting the company’s collapse was engineered by parties interested in taking control of Builder.ai’s intellectual property. Reports indicate he is currently considering a buyout via a pre-pack insolvency process.

Meanwhile, the legal consequences are quickly escalating. The U.S. Department of Justice has opened a criminal investigation into Builder.ai's financial disclosures, while bankruptcy filings reveal a list of over 200 creditors, including AWS and Microsoft, who are owed $88 million and $30 million, respectively.

Following the theme of my last newsletter on Power, Fraud & Espionage in Silicon Valley, more spies and spinners have now surfaced in the list of creditors disclosed in the bankruptcy filings. Among them is Tel Aviv-based private intelligence firm Shibumi Strategy, “founded by Israeli corporate espionage specialists”; Sitrick Group, a Los Angeles-based PR firm specializing in so-called crisis communications. Its founder, Michael Sitrick, has been described as “one of the most accomplished practitioners of the dark arts of public relations”, “The Winston Wolf of Public Relations,” “The Wizard of Spin”, “The spin doctor’s spin doctor” and the “Ninja Master of the Dark Art of Spin.” Also listed is T&M USA, another corporate intelligence firm. As the Financial Times frames it, this is part of a broader “reputational management industry,” which in this case also includes legal counsel Quinn Emanuel.

Builder.ai’s spectacular fall from grace underscores the urgent necessity for robust governance structures, transparent financial reporting, and genuine board oversight, particularly in startups riding waves of technological hype like AI. For investors and directors alike, Builder.ai serves as a stark reminder that governance failures, if left unchecked, can swiftly transform unicorn dreams into cautionary nightmares.

Empire Building in the Age of AI: Power, Secrecy, and the Battle for Control

On May 29th, I moderated a conversation with award-winning journalist and author Karen Hao at the Stanford Graduate School of Business. You can read the full event summary in this GSB write-up, or listen to the podcast version in E176 of the Boardroom Governance Podcast.

Karen Hao’s new book, Empire of AI, offers a gripping inside look at OpenAI and the global race for artificial intelligence supremacy. We discussed the origins and evolution of OpenAI, including its initial nonprofit structure, the influential roles played by Sam Altman and Elon Musk, and the dramatic shift toward a for-profit model.

We also explored critical governance and control issues, analyzed the controversial concept of AI Empires, and unpacked the boardroom drama surrounding leadership disputes and investor dynamics after Sam Altman’s ouster.

Karen shared insights into ethical considerations in AI development, compared AI advancements between the U.S. and China, and discussed the urgent need for thoughtful regulation.

Finally, we touched on the powerful roles of community activism and offered recommendations for startups navigating the complex landscape of AI governance.

Thanks again to Professor Anat Admati, Tina Mondragon, and my student Céline Vendler from Stanford's Corporations and Society Initiative (CASI) for the invitation.

VC-Backed Board Academy (VCBA) in San Francisco and New York City

Last month, the UC Center for Business Law San Francisco, which I lead, hosted the third VC-Backed Board Academy (VCBA). An impressive roster of speakers covered the key business and legal developments shaping the VC ecosystem, and attendees left better equipped to govern venture-backed companies in 2025 and beyond.

The next VCBA will take place on October 28, 2025, at Cooley in New York City.

Feel free to reach out if you have any questions about VCBA!

Boardroom Governance Podcast 🎙️

Check out my latest episodes:

E176 Karen Hao: Author of Empire of AI on Why “Scale at All Costs” is Not Leading Us to a Good Place. This special episode was recorded live at the Stanford Graduate School of Business on May 29th, where I moderated a conversation with Karen Hao. Her new book, Empire of AI, offers an inside look at OpenAI and the global race for AI supremacy.

E175 Michal Lev-Ram: On the Intersecting Worlds of Tech, Culture, and Politics in Silicon Valley. Michal Lev-Ram is a veteran journalist with deep ties to Silicon Valley. She shares her perspective on the current tech landscape in the midst of the AI boom. We also explore geopolitics, particularly developments in the Middle East, and the growing politicization of corporate America. Michal and I also discuss the tragic murder of Bob Lee, which she covered in depth in an article for Esquire, and reflect on the balance between creativity and accountability in today’s fast-changing tech environment.

E174 Alex Edmans: How Board Members Can Challenge Bias and Think More Critically. Alex Edmans is a Professor of Finance at London Business School and one of the leading voices in corporate finance and responsible business. In this episode, we discuss his books May Contain Lies and Grow the Pie, and the importance of directors critically evaluating the data and narratives presented to them. Alex explores common cognitive traps such as confirmation bias and black-and-white thinking, and emphasizes the value of diverse perspectives and a culture of constructive dissent in boardrooms.

You can listen to all the Boardroom Governance Podcast episodes in your favorite apps including Apple and Spotify.

If you like this show, please add your rating and review on Apple Podcast. It will help others find the podcast 🙏

If you and/or your organization is interested to sponsor the podcast, please do not hesitate to reach out to me.

The podcast is sponsored by The American College of Governance Counsel.

Other Relevant Corporate Governance News and Content

Meta reportedly is planning to invest around $14.8 billion for a 49% stake in Scale AI, with the startup’s CEO to lead a new Meta “superintelligence” AI lab. “The deal, which hasn’t yet been finalized, appears to be a rich one for Scale’s shareholders, with big paydays for some of Scale’s biggest investors such as Accel, Index Ventures, Founders Fund and Greenoaks, as well as current and former employees. Scale shareholders also would maintain their existing holdings in Scale, which will now be valued at $28 billion, including the cash invested, up from $13.8 billion last year.” “The unusual structure of the deal, and the fact Meta will own just 49% of Scale, could be an effort to avoid more regulatory scrutiny.”

Trends — Artificial Intelligence (May ‘25). This is a beast of a report by Mary Meeker and her partners at Bond Capital (at 340 slides). Some great quotes from the report, including:

“Increasingly, two hefty forces – technological and geopolitical – are intertwining. Andrew Bosworth (Meta Platforms CTO), on a recent ‘Possible’ podcast described the current state of AI as our space race and the people we’re discussing, especially China, are highly capable… there’s very few secrets. And there’s just progress. And you want to make sure that you’re never behind.”

“As investors, we always assume everything can go wrong, but the exciting part is the consideration of what can go right. Time and time again, the case for optimism is one of the best bets one can make.”

Here some additional take-aways:

AI’s Adoption Is Unprecedented: AI adoption is happening at record speed. ChatGPT hit 800M users in 17 months. Boards must treat AI as a near-term strategic priority, not a distant trend.

Costs Are Dropping Fast: AI compute costs have fallen 99% since 2020, making scaled deployment far more accessible. Boards should evaluate AI investment with fresh ROI assumptions.

Geopolitics Will Shape AI’s Future: Nations view AI as a national security issue. Boards need to monitor supply chain, regulatory, and trade risks tied to AI leadership.

Funding Outpaces Revenue (for Now): $95B invested, ~$11B in current revenue. Boards should push management to focus on sustainable, enterprise-grade AI applications over hype.

Talent & Learning Will Be Redefined: AI is reshaping education and workforce development. Boards should support upskilling, reskilling, and partnerships with AI-driven education platforms.

OpenAI’s New Path to Conversion Faces Activist Opposition. “OpenAI has backed off on its plans to carve out its for-profit business, which is responsible for ChatGPT, from its nonprofit charity arm. However, OpenAI’s new proposal to restructure its ownership hasn’t won over nonprofit advocates who opposed the original plan. The advocates are pressing the attorneys general in Delaware and California to ensure the restructuring doesn’t shortchange the charity.” There are two letters (dated April 17 and May 12) from a group called Not For Private Gain, signed by a group of law professors, attorneys, and former OpenAI employees, arguing that the nonprofit might not get fair value for its assets under OpenAI’s latest proposal.

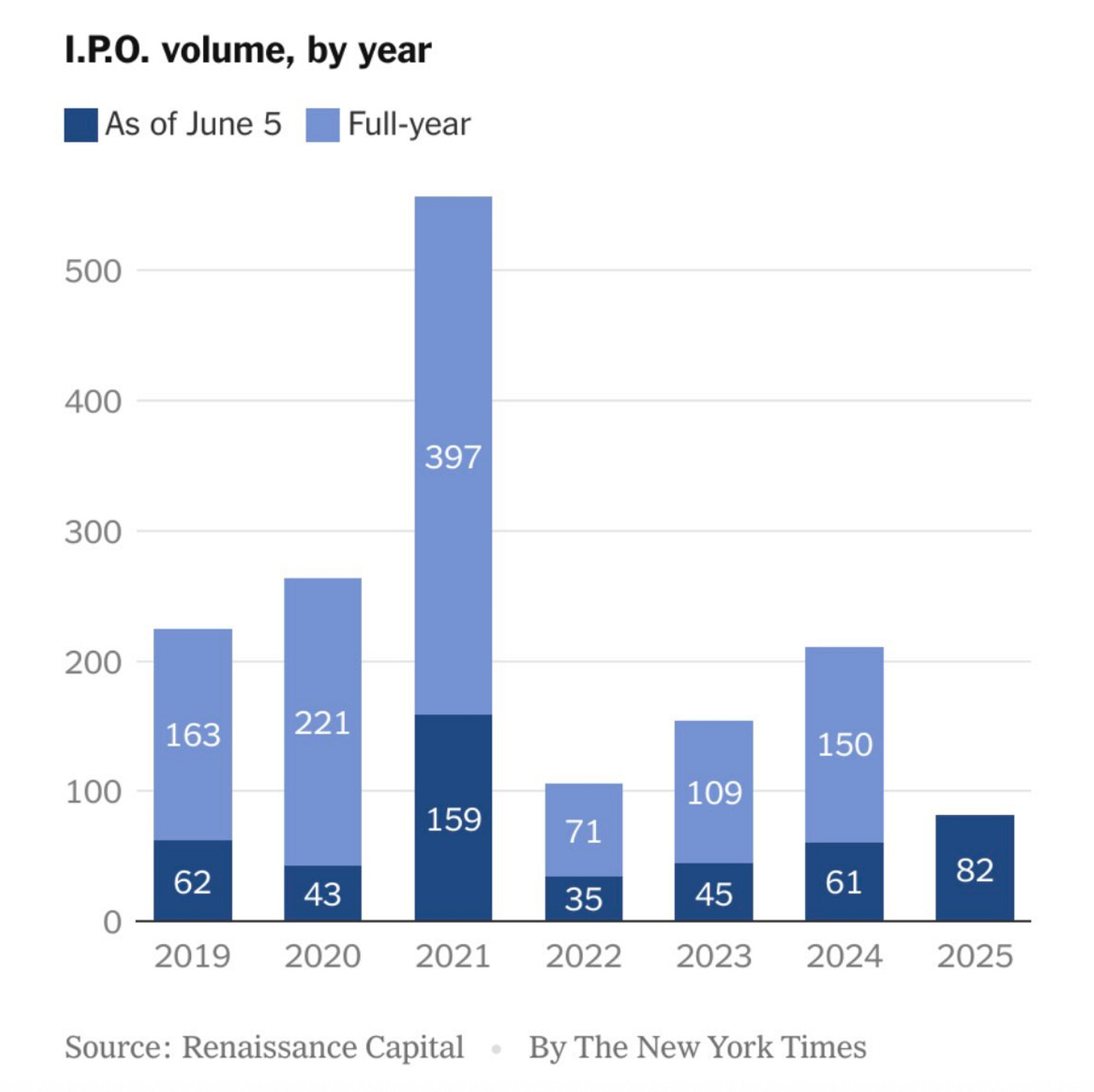

State of US IPO market. Chime opened today at $43 in Nasdaq debut after pricing IPO above expected range. Circle went public last week on the NYSE, pricing at $31, above the expected range, and then the stock went up from there. CoreWeave, which rents computing power to crypto and A.I. companies, and eToro, an investing app, are also trading above their listing prices.

Meta signs nuclear power deal with Constellation Energy. “Meta has signed a 20-year agreement to buy nuclear power from Constellation Energy. Beginning in 2027, the tech giant will purchase about 1.1 gigawatts of power from Constellation’s Clinton Clean Energy Center in Illinois. Without Meta’s backing, the plant was in danger of premature closure. Tech companies, including Amazon, Google and Meta, signed a pledge in March led by the World Nuclear Association calling for nuclear energy worldwide to triple by 2050.”

US National Debt Approaching $37 billion. It’s now rising by $1 Trillion every 180 days. Check out this US debt clock. Who’s paying attention?

OpenAI’s $6.5 Billion Deal to Boost Returns for Ive’s Backers. Impressive: “OpenAI owns 23% of Io, thanks to a design and development partnership closed at the end of last year. The acquisition terms valued OpenAI’s ownership at $1.5 billion, and OpenAI paid another $5 billion in stock for the company, for a total deal value of $6.5 billion. That’s a remarkable price for a 55-person business that hasn’t released a product or generated revenue. When Facebook bought Instagram in 2012, it also hadn’t generated revenue—but it already counted 30 million users.”

The geopolitics of power generation. A concerning chart for the U.S. compared to China:

The Immigrant Edge: How Foreign-Born Entrepreneurs Drive America’s Unicorn Boom. From Stanford Professor Ilya Strebulaev: “The next time someone talks about restricting immigration, show them this: Nearly half of America’s billion-dollar startups were founded by people born outside the United States.”

The Future of Venture Capital. Great podcast featuring Marc Andreessen discussing the evolution of the venture playbook, small vs large funds, the current AI landscape, politics and Silicon Valley, and tech’s relationship with the media:

Onward and upward.

Sincerely,

Evan Epstein

The bankruptcy filing was signed by directors Sachin Dev Duggal, Stephen Nundy (Lakestar) and Amit Anand (Jungle VC).